2. Examine Utilities And Services

As the impact of the virus continues to wreak havoc in the travel industry, it is important that you take stock of your essential business processes and fixed costs. Should things continue to get worse, it may be necessary to make difficult decisions to lower your financial obligations.

With many companies offering deals, now may be a great time to make upgrades and renovations to your property—but only if you can afford it. If funds at your business are tight, it may be wise to postpone any renovation and upgrade projects until we begin to emerge from this crisis and revenue becomes more stable.

If you are struggling, consider cutting back or revising services such as gardening or lawn care, and even utilities. Many large corporations and utility companies have been willing to offer small programs to assist customers during this time. Reach out to your suppliers to see if they are offering any deals or assistance such as payment deferment. Be transparent towards existing lenders, vendors, and service providers and involve them in your mitigating procedures.

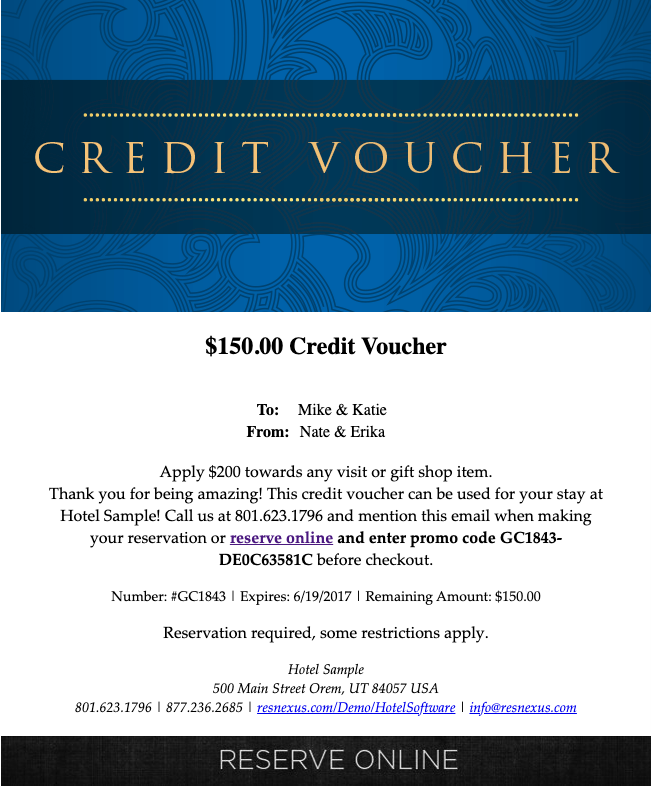

3. Look For Free Or Discounted Resources

There are organizations and programs out there that are ready and willing to help small businesses during these stressful financial times. For example, the Lawyers for Good Government Foundation offers pro bono legal consultations for small business owners throughout the country. The organization helps small businesses under 100 employees answer any COVID-19 related legal questions, and will pair your business with a lawyer that have expertise in the lodging industry. You can fill out their

contact information page and be alerted if and when they open a legal clinic in your area.

Other resources include programs such as SCORE, which include a network of thousands of retired business owners and expert volunteers. This includes volunteers with experience in the lodging industry. These volunteers can provide remote consultations for small business owners to meet and discuss business challenges during COVID-19.